When you buy a bottle of Coca-Cola, are you buying it from the store or from the Coca-Cola Company? Whose customer are you? In digital finance, the provider (usually a bank or telecom) designs and brands the service, but it is the agent that provides the ability to cash-in and cash-out (CICO), and earns 40-80% of the revenues from it.

So, whose customer is it? The strategic answer is that both parties are providing a service, and the customer can choose to buy a different provider’s service (e.g. Airtel Money vs. M-PESA), or the same provider’s service at a different location (e.g. walk to a different agent). Hence, both the provider and agent should have an interest in ensuring the customer is satisfied, and incentives should be aligned to achieve this.

While conducting CICO for a customer is similar to selling a bottle of Coca-Cola, registering a customer for digital finance is different. Most agents are used to conducting transactions, not actively selling a service. Agents interviewed for this research reported the perception that providers benefit from registering customers, not them. Hence, when conducting a registration they were serving the provider’s customer, not their own.

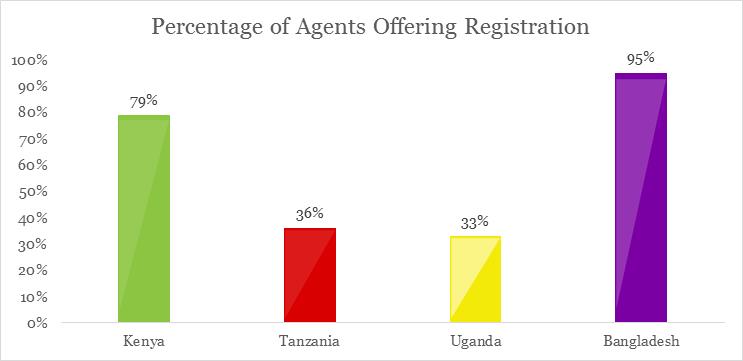

This helps explain the data from The Helix Institute below, showing not all agents are offering registration, especially in Tanzania and Uganda*. This is important because in most digital finance models registration has to happen before any transactions are done, and therefore any revenue is generated. The provider should design a support, training and incentive scheme to align the agent’s interests with theirs, but the first step is it to understand the agent’s underlying perceptions that drive their behaviour.

Registration is for Your Service not My Shop

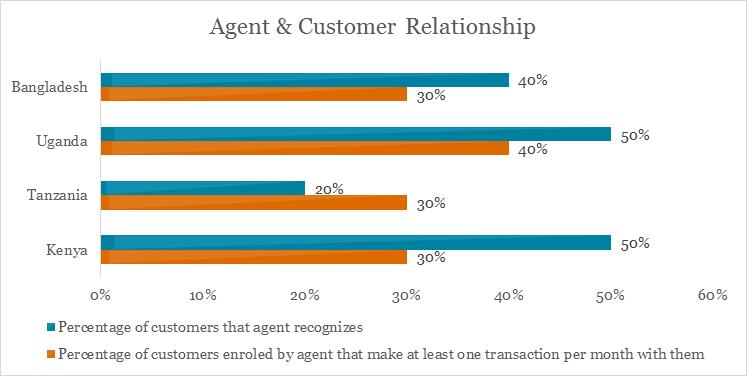

Agents report only 30-40% of customers that they register, return to transact at least once a month (orange bars in the below graph). This means on average they are registering customers that are not going to give them a lot of subsequent business and may become clients of competing agents in the area.

Agents questioned why they should actively recruit customers since they have no guarantee that new customers will be loyal to them. An agent said, “The customer may get to know about services from me, but go to another agent. What will be my reward for my efforts to sell to such a customer?”

Note: Data is from The Helix Institute of Digital Finance Agent Network Accelerator surveys from 2013-2014, and has not been previously published.

Stranger = Danger

Some agents view new customers as “suspect”, and thus choose to avoid any potential losses they may incur in serving the new, possibly “fraudulent” customers. These agent views stem from either their own, or another agent’s experience with fraud. In digital finance, agents report only recognizing 20-50% of clients (blue bars in the above graph), meaning this is a very common situation. One agent explained:

“When a customer I do not know walks into my shop I am on full alert. Sometimes if he looks suspect to me, I do not serve him. I just say I do not have float.”

Many agents prefer to serve customers with whom they are familiar, even though they know this may limit their profits. In these cases they are much more likely to view the customer as belonging to the provider, and some agents seem to only provide service to strangers on a case by case basis. Given these situations, where agents are not necessarily perceiving strangers as customers, it is important for providers to focus on support, training and agent incentives to try and encourage the provision of service.

Agents are Passive, so Support Them

Customer acquisition is not a natural role most agents play. As one agent reported, “It is not my job to look for new customers; that is the work of Safaricom.” Thus the provider needs to make the customer aware of the product, and curious enough to go and start asking an agent about it. Generally, the agent will not start this conversation for the provider. This awareness and curiosity is built through highly visible and sophisticated above-the-line (ATL) marketing strategies common in the telecom industry, and must be done by all providers, or else agents will not feel supported.

Agents also compare their affiliated provider’s marketing efforts to competitors. Some Airtel money agents do not engage in active recruitment of customers because they perceive Airtel to be passive. An agent explained:

“Airtel should encourage more customers to join their network just like Safaricom does. Every day Safaricom is doing an advert in the dailies, and that is why they have many customers. So if Airtel is not as actively engaged as Safaricom and is struggling to get customer numbers, what about us agents?”

Providers need to do the requisite marketing to bring the customers into the agency, already on their way to wanting to register, and then incentivize and train the agents to close the sale and process the registration.

Agents need Motivation, so Train & Incentivize Them

MicroSave has consulted a lot of providers on designing their agent training curriculums. One of the major trends is that usually the training manuals are focused very much on compliance, and processes, and seldom do they have a sales component. It must be understood that agents need this type of training to understand how to pitch the value proposition with confidence, and tact.

The marketing and training support are crucial so that customers come in to the store, and agents know what to do when it happens, however, the agent also must be motivated to employ their training. Successful providers understand this and report paying over one U.S. dollar per customer acquired. Good incentive schemes make commissions payment contingent on the customer making at least one deposit so the provider can better ensure the customers interest in the service, and some incentive schemes also give the agent commission on some of the ensuing transactions the customer makes, to ensure the agent makes more than a one-time fee.

It would be interesting to further look at transaction commissions to investigate if agents could offer loyalty schemes (e.g. make five transactions with me this month and get the sixth free) to customers to encourage more ownership of them as well.

Conclusion

Theoretically customers are shared by agents and providers, but practically, the agents perception is different for different customers (ones they know vs. strangers) and the activity required (registration vs. CICO). Providers need to understand this to better support agents with marketing efforts, training, and aligned agent incentives, so that they feel more ownership over the customer relationship. This should help improve agent motivation to provide a consistently high quality of service to all customers.

*More data on service offerings is available from The Helix Institute country reports on Kenya, Tanzania, Uganda, and Bangladesh. Data in East Africa was collected in 2013, and Bangladesh data was collected in 2014.