With special thanks and acknowledgement to Abhinav Sinha (EKO India), Tamara Cook (FSD Kenya), Kwame Oppong (CGAP), Paul Mbugua (Eclectics), Paul Musoke (FSD Africa), and Abigail Komu (Independent Consultant).

Some people may argue that agent networks will soon go extinct. Even if that is the case, it will not happen until long into the future. In our opinion, agents in the developing world, where about 75% of the unbanked populations live, will remain the core bridges between cash and digital value. Agent network management, however, remains the most operationally burdensome and, at between 40–80% of business revenue, costly element of the digital financial service (DFS) value chain.

On 23rd June 2017, MicroSave wrapped up its four-year expedition, namely the ‘Agent Network Accelerator Programme’ (ANA) with a day-long workshop held in Nairobi. Industry experts and representatives of various stakeholder institutions across the globe came to deliberate on the lessons learnt over the years and discuss the next generation of agent models.

From the surveys conducted by The Helix Institute, including the nationally representative ANA surveys, it is clear that most financial service providers now understand the key challenges to agent network management, as well as their ultimate obligation to move beyond the role of agents as bridges. Providers should be designing strategies that take market evolution into consideration. On the demand side, the needs, preferences, and perceptions of customers are changing. Meanwhile, on the supply side, it is increasingly becoming vital to manage costs while providing services to all market segments efficiently.

The workshop in Nairobi identified two critical elements that form the basis of future-proof agent network deployment strategies. These two elements – interoperability and innovation – ensure sustainable agent models that are able to respond to rapidly changing business environments.

Interoperability

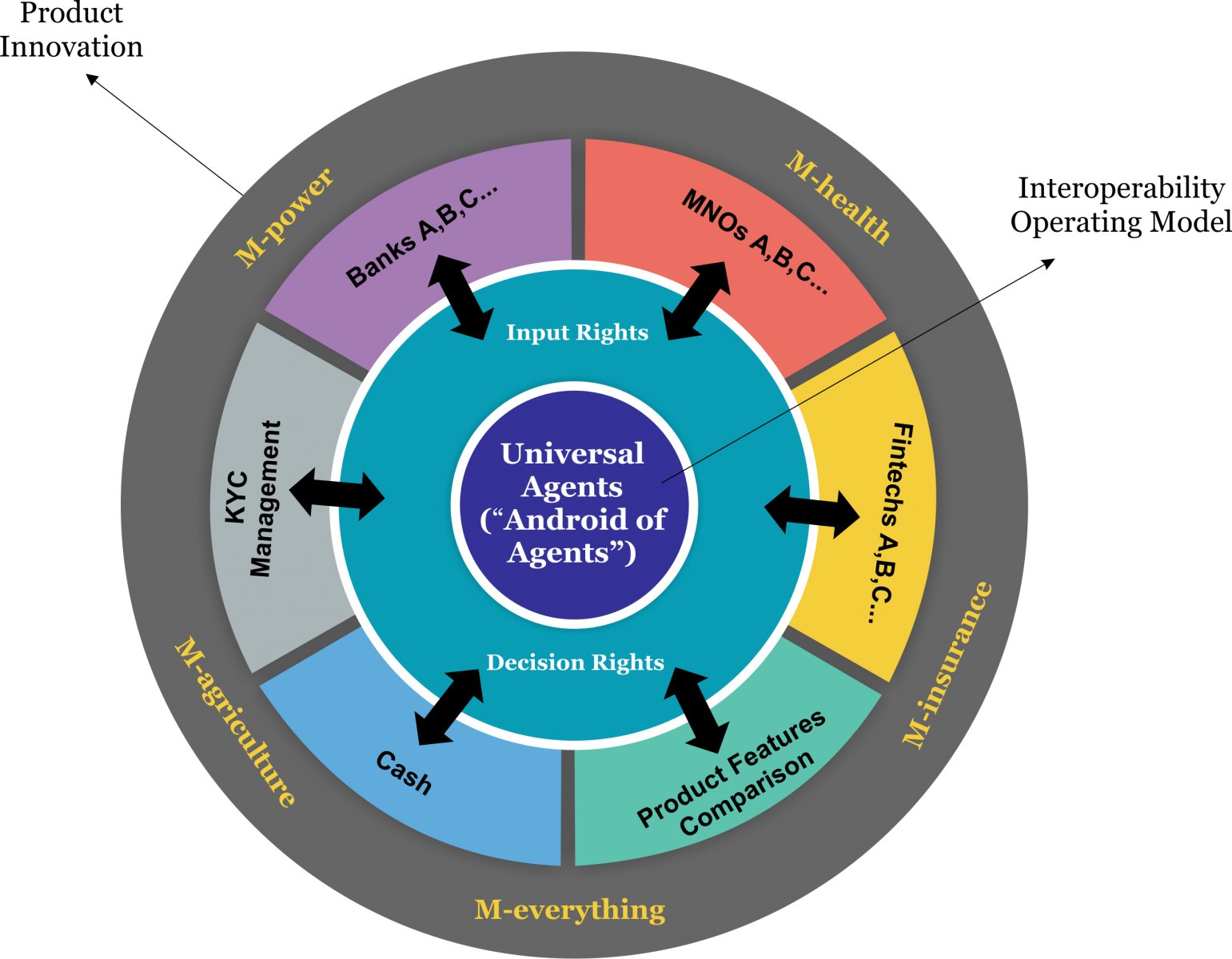

As long ago as 2012, industry experts identified an open and fully interoperable market as the future. A lot of writings have focussed on interoperability and its benefits. Yet here, at the axis of interoperability lies the “android of agents”, or a universal agent. What this means is that industry players should serve customers through a shared agent network. Thus, banks, mobile network operators, and third-party fintech entities would all share a universal agent. This universal agent does not need to hold separate e-values for each client, unlike most non-exclusive agents today. At the core of the universal agent’s services is a comparison of the products and services from the different players, which creates a more transparent market and allows customers to easily access information.

On the supply side of the ecosystem, a unified platform would help customers access financial services from anyone who wishes to offer them. Shared agents and a unified e-currency will allow providers to focus on offering relevant products and not on building expensive agent networks or channels that eat into their bottom line.

On the demand side, customers are increasingly changing and are beginning to look beyond the available products. They are keen to avail premium services that go with product delivery. There has been a revolution in financial services, as it has evolved to mobile, wearable devices, and the Internet of Things (IOT). Customer expectations from financial service providers have evolved as well. Now, more than half of consumer bank interactions take place through online or mobile channels.

A recent report by Accenture identified a number of factors that have brought about change in the digital finance landscape. The report notes that consumers are increasingly willing to share more of their personal data in anticipation of benefits from providers. Digital platforms attract younger consumers as an alternative for accessing financial services, while more customers are starting to accept automated support services. In the light of such trends, financial service providers have to engage in constant innovation and develop novel products and services to survive.

The players behind the universal agent described above collectively create the ‘finance store’. Providers, therefore, compete in terms of product and not channel. Customers then assess what is available at the universal agent points, where they choose their own products and use-cases.

Providers have been building expensive distribution networks, and often struggle to keep up as customers’ needs evolve to demand easier and quicker access. It is therefore wise to focus on the product offering and share agent channels to respond to changing demand quickly.

|

The workshop experts see the potential of an amalgamation of industries, which enable institutions to work together and provide value-added services to basic financial provisions. For the low-income segments, let us consider the basic human needs of food, shelter, and clothing. How are customers spending to meet these requirements? How can financial service providers partner with entities in these sectors to create value-added products and services, and make their offerings relevant to the populace? On considering other higher income segments, what extras beyond the basic requirements do customers spend on? What other value-added services can be created? The answers to these questions will inform the strategies of financial services for the future business case of the agents. A good example of this amalgamation is how digital financial services have been transforming agriculture (m-agric). Laying down the necessary digital payment structures in agriculture is important to improve the sector. When this is achieved, subsequent growth of other components of financial services will be realised. One such component is access to credit, which is fundamental to agriculture value chains. Example: Umati Capital (UCAP) in Kenya Umati Capital is a non-bank financial intermediary that focusses on the provision of supply chain finance across various value chains. They leverage technology to provide financing to SMEs who supply to their corporate trading partners. Umati Capital seeks to address two key problems for its identified customer segments: • Access to working capital for small business suppliers of medium and large-sized corporates; • Provision of a supplier financing programme that is tailored to the supplier’s payment cycles. Currently engaged in the dairy sector in Kenya, UCAP uses technology to make faster lending decisions. With funds from angel investors, UCAP has set up mobile applications throughout each stage of the value chain to capture data and inform their disbursal of smallholder farmer loans via mobile wallets. UCAP has currently been running a pilot with 320 dairy farmers. The results are promising and Umati Capital has plans to scale up two major processors to reach 200,000 dairy farmers. |

Innovation

Providers need rapid innovation to respond to the changing demands of consumers. In the future, providers will need to continue prioritising innovation. They must deliver financial services that respond to the market’s needs and mental models for money management, and thus have a real social impact.

Innovation that is driven by the amalgamation of industries has already begun with m-agric, m-health, m‑water, m-power, etc. But it is yet to scale due to the lack of data-sharing and analytics that could potentially make the services relevant to their customers’ everyday lives. This is crucial and should be considered to create more digital use-cases for customers. The ‘universal agent model’ will create a richer data pool, where identifying the 5Vs of data (value, volume, velocity, veracity, and variety) will enhance the continued innovation of products. Product innovation that focusses on meeting customer demands will be essential to sustain the agent network and safeguard agent viability.

How do we ensure provider buy-in?

It is evident that a lot is to be gained through these types of strategies for the future. These gains include, among others, new products, higher quality, less-costly agent networks, improved liquidity management, money that remains digital in the ecosystem, new customers, and new use-cases.

However, there are some impediments to adoption by financial service providers, as outlined in the following section.

1: Sunk Costs: Many providers have made large investments in the form of expenses, time, and effort in legacy systems or distribution models. How can they now put that aside and become open to sharing? Understandably, the providers would be keen to reap the rewards from existing systems and agent networks before entering the coopetition (collaborating while competing) arena. In fact, many providers see their agent networks as a key source of competitive advantage. This will be a question of timing and nature of the market. Yet, as the market ultimately evolves, attempts to hold on to the past will only ensure their obsolescence. As the future unfolds, the platforms and distribution networks of providers are expected to become increasingly irrelevant.

2: Time Horizon: As GSMA has pointed out, both significant investments and serious intent are required to ensure that mobile money systems flourish and yield profits. Indeed, this is the key differentiator between mobile money deployments that ‘sprint’ and those that ‘limp’. But many providers already under-invest in a business that calls for large-scale upfront as well as ongoing investments to achieve scale and succeed. So it is fair to assume that many providers will hesitate to embrace further investment in the future because they anticipate long break-even periods. In this case, it is ideal to see things from a collective perspective – considering multiple entities/providers – where there would be a merger of volumes from the combined customer base, combined transactions numbers, etc. The break-even ball game would change from being linear, where a provider hopes to make profits after a period of time from expected transactions for a single source, to a stage where the provider makes profits from parallel sources due to partnerships. An instance of this is the monies raised from opening APIs, where there is a technological cost to every API call.

3: Risks: Providers are likely to express concerns about unforeseen or expected new risks that would arise through the coopetition model. However, there is a need to embrace risk to design robust mitigation strategies to provide financial services. It calls for collectively identifying and documenting risks as and when they occur, as a measure of planning against future occurrences. Indeed, the coopetition model is likely to facilitate sharing information and integrating systems to better mitigate risk. Fearing risk will simply inhibit innovation as the market evolves.

Conclusion

Is it possible to begin developing tomorrow’s distribution network today? How do we develop deployments that enable and facilitate the demand and supply equilibrium? The solution lies in finding that equilibrium. This can be explored by enabling a single e-currency to serve multiple financial services, developing a real-time self-initiated request platform for customers, encouraging innovation and coopetition, and aiming at social impact for daily relevance. The future starts tomorrow!