Service Offerings at Agents are Static & Rudimentary

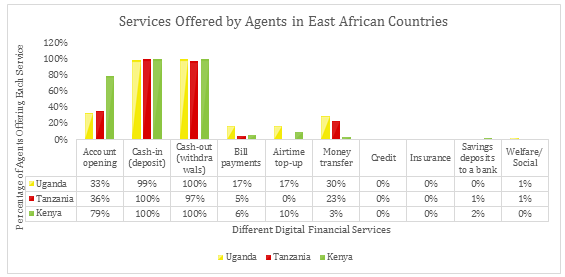

Across East Africa The Helix Institute’s research (2013) is showing that even after seven years of market development in Kenya, six years in Tanzania and five in Uganda, agents are still providing the same very rudimentary services that they did from the beginning. The graph below shows that just about all of them provide both cash-in and cash-out services for customers, but that those are the only services which are provided in any uniform manner across countries.

In Kenya, 79% of agents also report offering account opening services for new customers, but both Tanzania and Uganda lag far behind here. In Uganda, significantly more agents are involved in airtime top-up and bill pay compared to its East African counterparts, however, even in Uganda, 83% of agents do not offer these services. Money transfers (also referred to as direct deposits) are not another service, but just a way that customers try to circumvent paying a P2P transfer fee by having agents send the money for them and is actually something most East African providers try to eliminate.

Commissions Structure & Desire for Speed to Scale Drives This Pattern

This often confuses people who correctly understand that airtime top-ups and bill-pay are major drivers of volumes and values on digital finance platforms. The difference is in East Africa they are executed on the handset and not at the agents.

There are two major factors driving this trend, the first financial and the second related to scale. The first issue is the manner in which most East African providers structure their pricing and commissions, best explained here by Ignacio Mas. Basically, providers lose money when customers cash in, because the customer does not pay a fee, yet the agent earns a commission. Further, they have to share the revenue they make on cash-outs with the agent, as the agent is actually physically conducting the transactions and needs an incentive to do so. However, providers earn and retain 100% of the revenue from transactions made over the handset. Therefore, in order to limit the amount of commissions they have to pay to agents, and increase the amount of revenue that they earn directly, services are designed to incorporate the agent as little as possible.

The second major reason is speed to scale. If a service can be offered digitally, then it is easier for it to grow virally. People can enroll and use it anytime, anywhere, and all the impediments of paperwork and having to deal with a person are eliminated.

Agent Banking Growing, but Just in Kenya, and is Still Relatively Small

From both a business model perspective, and a financial inclusion perspective, we should be most interested in the absence of the sophisticated financial services on the right side of the chart (savings, credit and insurance). These are services that are likely to create more transactions per customer (revenue), and also play a greater role in supporting customers to manage their money (financial inclusion).

Banks like Equity Bank, Kenya Commercial Bank (KCB), and Co-operative Bank are now building agent networks in Kenya that allow people to access banking services at the agent level, but relative to the telecom’s mobile money agent networks, the banks’ efforts are still eclipsed in the country figures, and therefore only really show-up as the 2% in the deposit column for Kenya on the above chart. Uganda is still waiting for agent banking regulation that would allow banks to enter the market, and in Tanzania, the banks are far behind the developments in Kenya.

Channel Detachment for Next Generation Services

The next generation services like M-Shwari and M-Benki in Kenya and M-Pawa in Tanzania are examples of the more sophisticated banking services that have been lacking in the industry. All three services provide savings and credit to customers. They offer the potential to increase revenue for the providers, as well as provide more useful services for the mass market customer. However, like P2P, airtime, and bill pay that came before them, they are all being offered exclusively over the handset, detached from the agent channel.

Customers enroll on their handset, and then mostly just move e-value from their mobile wallets to and from these services. To cash-out (withdraw) from the services, agents are still involved, but the key is that they are not incorporated in the enrolment process or the subsequent support services. Therefore, this new generation of exciting new services is detached from the agent channels that have historically been defining features of successful roll-outs.

M-Shwari was the first of these next generation services to hit the market, and about a year later, after a marketing campaign that was largely detached from the channel, InterMedia data shows that only 10% of Kenyan adults report having used it. This is far from the viral growth which we all hoped to see and the channel detachment that characterized its launch is likely a key factor in the lower than expected results.

Channel Involvement to Support Growth & Uptake

During this launch and initial growth phase, the most important activity to focus attention on is the detachment of the marketing campaign from the channel. Most marketing for these products has been above-the-line, focusing on mass media advertising, billboards and banners. While that was also a crucial component of the marketing when mobile money was launched, the big difference was that it was complemented heavily by below-the-line strategies which in the case of M-PESA in Kenya involved spending 10-15 minutes with each customer explaining the service, and paying over a dollar per customer acquired in commissions.

The current approach seems to assume that now that this expensive time consuming customer acquisition has been done, customers will now register for new products directly over the handset given some advertising to make them aware of the opportunity. However, savings is different from other transfers and payments in that the person who is saving must have an order of magnitude more trust in the provider offering the service.

Customers are no longer just trusting the provider to quickly transfer value to someone they can verify with immediately. Saving money or buying insurance, the customer gives the provider money to hold, and must trust the provider over the entire duration of the policy cover, or life of the deposit. This is a tough sell for a digital system most people still do not understand, and tougher sell for a digital system without a human face that can assure mass market customers it will work for them, and actually help solve some of their specific problems.

Concluding Thoughts

While offering simple transfer services digitally over the handset has taken-off in East Africa, scaling them digitally has not. The lynchpin is likely in finding the right people on the ground to sell these more complex products. Not all agents in the existing East African networks will be able to do this as it is fundamentally a different skill than conducting transactions, but there definitely will be an overlap, and given the trusting relationships many have with customers, this seems like a good starting point. For the agents that cannot evolve to sell as well, they can be supplemented with sales agents who roam around professionally pitching the product.

After several years of development in the industry we do seem ready to make the leap to more sophisticated services, however, given the business models the telecoms have developed that encourage channel detachment, it might just be the banks – slow and steady – that invest correctly in the human touch that brings the needed trust.

InterMedia (with funding from the Gates Foundation) and the The Helix Institute of Digital Finance (a joint partnership between MicroSave, The Gates Foundation, the IFC and The UN Capital Development Fund) together, have collected the largest datasets in the world on digital finance (mobile money and agent banking), and the results are beginning to challenge some of our long held beliefs about how these systems work and what people are using them for. The research focuses on eight digital finance markets around the world, with InterMedia responsible for the demand data from the customer perspective, and The Helix Institute complimenting it with supply data from the providers offering these services.